Moniepoint started by making financial services accessible through a vast network of agents. They’ve grown from there to become a full-fledged microfinance bank, offering a wider range of financial products like loans and account management directly through their mobile app. This evolution allows them to better serve the needs of both businesses and individuals in Nigeria.

Moniepoint microfinance bank focuses on empowering businesses and individuals in Nigeria by providing them with:

- Accessible Financial Services: Moniepoint’s extensive network, previously as an agent banking network, reaches areas where traditional banks may not. This allows individuals and businesses, especially those in remote areas, to easily access financial services like opening accounts, making payments, and receiving funds.

- Financial Tools for Growth: Moniepoint offers business banking solutions like mobile apps for managing finances, working capital loans to support business expansion, and potentially credit cards for business purchases. These tools can help businesses improve their financial health and achieve growth.

- Everyday Banking Solutions: With the launch of personal banking services, Moniepoint empowers individuals by providing them with basic banking services they might not have had access to before. This could include checkings accounts for saving and managing money, debit cards for making purchases, or mobile banking for easy access to accounts.

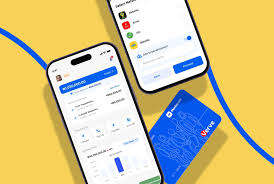

- User-Friendly Technology: Moniepoint’s user-friendly mobile app allows both businesses and individuals to manage their finances conveniently, without the need to visit a physical branch. This can save them time and money.

By providing these accessible financial tools and services, Moniepoint empowers businesses and individuals to participate more fully in the Nigerian economy.

Moniepoint Microfinance Bank: Empowering Businesses and Individuals in Nigeria

Moniepoint Microfinance Bank has evolved from an agent banking network to a full-fledged financial institution, all with the goal of empowering businesses and individuals in Nigeria. With over 3 million customers and businesses on board, and a staggering 33 million+ card users every month, Moniepoint boasts a significant reach in the Nigerian market.

Moniepoint microfinance bank focuses on empowering businesses in Nigeria by providing them with a comprehensive suite of business banking solutions through their user-friendly mobile app. Here’s a breakdown of some key features:

- Mobile Business Banking App: Moniepoint’s business banking revolves around their mobile app, which allows business owners to manage their finances from anywhere, anytime. This eliminates the need for frequent visits to

physical banks, saving them valuable time and resources.

- Account Management: Business owners can open a business bank account directly through the app, receive account statements, and monitor transactions. This provides them with a clear view of their business finances and helps them make informed decisions.

- Payments and Money Transfers: The app facilitates sending and receiving business payments easily and securely. Business owners can make bulk payments to suppliers, employees, or contractors, and receive payments from customers directly into their accounts.

- Airtime Purchase and Bill Payment: Moniepoint’s app allows businesses to conveniently purchase airtime for their phones and pay various utility bills directly within the app. This streamlines day-to-Đồng (Vietnamese Dong) operations and eliminates the need for multiple platforms for different tasks.

- Expense Cards: Businesses can request expense cards for their employees. This enables employees to make authorized business purchases without having to use personal funds. It also provides businesses with better expense tracking and control.

- Working Capital Loans: Moniepoint recognizes the financial needs of growing businesses and offers working capital loans to help them bridge funding gaps and support their expansion plans.

By providing these features, Moniepoint empowers businesses in Nigeria to:

- Improve Efficiency: The mobile app streamlines business banking tasks, saving business owners time and resources.

- Gain Control: Easy access to account information and features like expense cards allows for better financial management and control.

- Grow Their Business: Access to working capital loans can help businesses invest in growth opportunities and achieve their goals.

Moniepoint Personal Banking (Launched August 2023):

Moniepoint’s personal banking arm, launched in August 2023, aims to complement their existing business banking solutions and further empower Nigerians by:

- Serving Business Ecosystems: They target not just business owners but also their customers and employees. This creates a more comprehensive financial ecosystem for businesses and fosters loyalty among customers and staff who can now bank conveniently with the same platform used by their employers.

- Everyday Banking Needs: Moniepoint offers core personal banking services that can be tailored to individual needs. Their website likely details these services, but they might include:

- Account opening: Easy account opening process through the Moniepoint app.

- Money transfers: Send and receive money to other Moniepoint accounts or other banks in Nigeria.

- Bill payments: Pay bills for utilities, subscriptions, etc. conveniently through the app.

- Airtime/Data purchase: Top up your phone or buy data plans directly within the app.

- Debit cards: Reliable debit cards (potentially Mastercard and Verve) for making purchases at ATMs, POS terminals, and online stores.

- Security: Secure transactions with features like PIN verification and potentially two-factor authentication.

Unconfirmed Services (check Moniepoint website for details):

- Salary accounts: Businesses can potentially choose Moniepoint for salary disbursements to employees.

- Savings accounts: Options for saving money and potentially earning interest.

- Loans (future offering): Moniepoint might expand to offer personal loans in the future.

By providing these personal banking services, Moniepoint positions itself as a one-stop shop for both businesses and their associated individuals, promoting financial inclusion and offering a convenient banking experience.

Moniepoint boasts several strengths that position it as a leader in financial inclusion for Nigerians, particularly for businesses and individuals who might not have easy access to traditional banking services. Here are some key highlights:

- Extensive Network: Moniepoint holds the title of largest distribution network for financial services in Nigeria. This means they have a wider reach than many traditional banks, with a presence in areas that might be unbanked. This extensive network makes it easier for businesses and individuals to access their services, regardless of location.

- Technology: Moniepoint emphasizes a user-friendly mobile app that empowers both businesses and individuals. The app allows for business management and banking activities all in one place. This includes features like managing accounts, receiving and making payments, purchasing airtime and data, and even managing expense cards. This focus on user-friendly technology makes it easier for people to adopt and benefit from Moniepoint’s services.

- Security: Building trust is essential, especially in financial services. Moniepoint prioritizes security by being CBN-licensed and NDIC-insured. This means they operate under the regulations of the Central Bank of Nigeria (CBN) and that deposits are insured by the Nigeria Deposit Insurance Corporation (NDIC). This can give users peace of mind knowing their money is protected.

- Recognition & Awards: Moniepoint’s achievements haven’t gone unnoticed. They’ve been recognized for their contributions to financial inclusion, having received awards like the CBN’s “Most Inclusive Payment Platform” award in 2022. This recognition highlights their positive impact on the financial landscape in Nigeria.

These strengths, particularly the extensive reach, user-friendly technology, and focus on security, all contribute to Moniepoint’s ability to empower businesses and individuals in Nigeria.

Moniepoint boasts several strengths that position it as a leader in financial inclusion for Nigerians, particularly for businesses and individuals who might not have easy access to traditional banking services. Here are some key highlights:

- Extensive Network: Moniepoint holds the title of largest distribution network for financial services in Nigeria. This means they have a wider reach than many traditional banks, with a presence in areas that might be unbanked. This extensive network makes it easier for businesses and individuals to access their services, regardless of location.

- Technology: Moniepoint emphasizes a user-friendly mobile app that empowers both businesses and individuals. The app allows for business management and banking activities all in one place. This includes features like managing accounts, receiving and making payments, purchasing airtime and data, and even managing expense cards. This focus on user-friendly technology makes it easier for people to adopt and benefit from Moniepoint’s services.

- Security: Building trust is essential, especially in financial services. Moniepoint prioritizes security by being CBN-licensed and NDIC-insured. This means they operate under the regulations of the Central Bank of Nigeria (CBN) and that deposits are insured by the Nigeria Deposit Insurance Corporation (NDIC). This can give users peace of mind knowing their money is protected.

- Recognition & Awards: Moniepoint’s achievements haven’t gone unnoticed. They’ve been recognized for their contributions to financial inclusion, having received awards like the CBN’s “Most Inclusive Payment Platform” award in 2022. This recognition highlights their positive impact on the financial landscape in Nigeria.

These strengths, particularly the extensive reach, user-friendly technology, and focus on security, all contribute to Moniepoint’s ability to empower businesses and individuals in Nigeria.

Moniepoint boasts several strengths that position it as a leader in financial inclusion for Nigerians, particularly for businesses and individuals who might not have easy access to traditional banking services. Here are some key highlights:

- Extensive Network: Moniepoint holds the title of largest distribution network for financial services in Nigeria. This means they have a wider reach than many traditional banks, with a presence in areas that might be unbanked. This extensive network makes it easier for businesses and individuals to access their services, regardless of location.

- Technology: Moniepoint emphasizes a user-friendly mobile app that empowers both businesses and individuals. The app allows for business management and banking activities all in one place. This includes features like managing accounts, receiving and making payments, purchasing airtime and data, and even managing expense cards. This focus on user-friendly technology makes it easier for people to adopt and benefit from Moniepoint’s services.

- Security: Building trust is essential, especially in financial services. Moniepoint prioritizes security by being CBN-licensed and NDIC-insured. This means they operate under the regulations of the Central Bank of Nigeria (CBN) and that deposits are insured by the Nigeria Deposit Insurance Corporation (NDIC). This can give users peace of mind knowing their money is protected.

- Recognition & Awards: Moniepoint’s achievements haven’t gone unnoticed. They’ve been recognized for their contributions to financial inclusion, having received awards like the CBN’s “Most Inclusive Payment Platform” award in 2022. This recognition highlights their positive impact on the financial landscape in Nigeria.

These strengths, particularly the extensive reach, user-friendly technology, and focus on security, all contribute to Moniepoint’s ability to empower businesses and individuals in Nigeria.

Conclusion

Moniepoint boasts several strengths that position it as a leader in financial inclusion for Nigerians, particularly for businesses and individuals who might not have easy access to traditional banking services. Here are some key highlights:

- Extensive Network: Moniepoint holds the title of largest distribution network for financial services in Nigeria. This means they have a wider reach than many traditional banks, with a presence in areas that might be unbanked. This extensive network makes it easier for businesses and individuals to access their services, regardless of location.

- Technology: Moniepoint emphasizes a user-friendly mobile app that empowers both businesses and individuals. The app allows for business management and banking activities all in one place. This includes features like managing accounts, receiving and making payments, purchasing airtime and data, and even managing expense cards. This focus on user-friendly technology makes it easier for people to adopt and benefit from Moniepoint’s services.

- Security: Building trust is essential, especially in financial services. Moniepoint prioritizes security by being CBN-licensed and NDIC-insured. This means they operate under the regulations of the Central Bank of Nigeria (CBN) and that deposits are insured by the Nigeria Deposit Insurance Corporation (NDIC). This can give users peace of mind knowing their money is protected.

- Recognition & Awards: Moniepoint’s achievements haven’t gone unnoticed. They’ve been recognized for their contributions to financial inclusion, having received awards like the CBN’s “Most Inclusive Payment Platform” award in 2022. This recognition highlights their positive impact on the financial landscape in Nigeria.

These strengths, particularly the extensive reach, user-friendly technology, and focus on security, all contribute to Moniepoint’s ability to empower businesses and individuals in Nigeria.

Moniepoint Microfinance Bank FAQs

General

What is Moniepoint?

- Moniepoint is a microfinance bank in Nigeria offering financial services to businesses and individuals.

Is Moniepoint safe?

- Yes, Moniepoint is CBN-licensed and NDIC-insured, meaning they operate under regulations and your deposits are insured.

Accounts

What types of accounts does Moniepoint offer?

- Moniepoint offers business and personal accounts.

How do I open a Moniepoint account?

- You can likely find information on opening an account on the Moniepoint website or app. They may also allow you to open an account through their agent network.

Mobile App

Does Moniepoint have a mobile app?

- Yes, Moniepoint has a mobile app for both businesses and individuals for managing finances.

- What can I do with the Moniepoint app? (tailor to business or personal depending on audience)

- Business: Manage accounts, receive and make payments, purchase airtime and data, manage expense cards.

- Personal: Potentially check account balance, make transfers, pay bills (check details on their website).

Business Services

What business banking services does Moniepoint offer?

- Moniepoint offers a mobile app for business management, working capital loans, and may offer other services like expense cards.

Is Moniepoint good for small businesses?

- Moniepoint’s focus on mobile technology, loans, and potentially expense cards makes them a strong option for small businesses.

Personal Services (if applicable)

What personal banking services does Moniepoint offer?

- You can likely find details on their website, but it may include everyday banking services like accounts, debit cards, and mobile banking.

Is Moniepoint a good alternative to traditional banks?

- Moniepoint may be a good option for those who prefer a user-friendly mobile app or those who may not have easy access to traditional banks.

Additional FAQ sections you might consider:

- USSD code (if Moniepoint offers one)

- Loans (if applicable)

- Debit/Expense Cards (if applicable)

- Security

Remember: It’s always best to refer to the official Moniepoint website or app for the most up-to-date information on their services and FAQs.

2 thoughts on “Moniepoint microfinance bank in Nigeria all you need to know.”